The Importance of Financial Literacy in Primary Education

cricbet99, sky99exch, reddy club book:Financial literacy is a crucial skill that everyone should possess, no matter their age. However, it is particularly important to start educating children about financial concepts from a young age. That’s why incorporating financial literacy into primary education is so essential.

In today’s society, children are exposed to money and financial decisions at a very early age. From saving their allowance to learning about budgeting for school supplies, the financial decisions children make now can impact their future. By introducing financial literacy into primary education, we can help children develop a strong foundation of financial knowledge that will benefit them throughout their lives.

Here are some key reasons why financial literacy in primary education is so important:

1. Building good money habits early on

By teaching children about basic financial concepts such as budgeting, saving, and investing, we can help them develop good money habits from a young age. These habits can carry over into adulthood and set them up for financial success.

2. Empowering children to make informed financial decisions

Financial literacy education can empower children to make informed decisions about money. By understanding the consequences of their financial choices, children can learn to prioritize their spending, save for the future, and avoid debt.

3. Fostering a sense of responsibility and independence

Learning about financial literacy can teach children important life skills such as responsibility and independence. By managing their own money, children can learn to make decisions independently and take ownership of their financial future.

4. Preparing children for the future

In today’s complex financial landscape, it is more important than ever for children to have a basic understanding of financial concepts. By equipping children with financial literacy skills, we can help prepare them for the financial challenges they will face as adults.

5. Reducing financial stress and anxiety

Financial literacy education can help children develop a sense of financial security and reduce financial stress and anxiety. By understanding how to manage their money effectively, children can feel more confident in their financial decision-making abilities.

Incorporating financial literacy into primary education is essential for preparing children for the future and empowering them to make informed financial decisions. By teaching children about basic financial concepts from a young age, we can help them build good money habits, develop a sense of responsibility and independence, and reduce financial stress and anxiety.

FAQs:

1. What age should financial literacy education begin?

Financial literacy education can begin as early as kindergarten, with age-appropriate lessons about saving, spending, and sharing. As children get older, more advanced concepts can be introduced to help them develop a deeper understanding of financial concepts.

2. How can parents support financial literacy education at home?

Parents can support financial literacy education at home by talking to their children about money, setting a good example with their own financial habits, and involving children in financial decisions such as budgeting for family activities or saving for a specific goal.

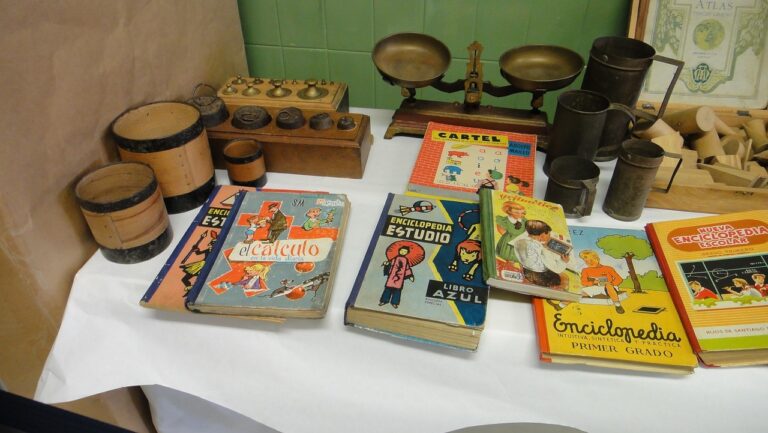

3. What resources are available to help teach financial literacy in primary education?

There are a variety of resources available to help teach financial literacy in primary education, including curriculum materials, online resources, and financial literacy programs. Teachers can also incorporate real-world examples and hands-on activities to make financial literacy education more engaging for students.